Practice Free MB-310 Exam Online Questions

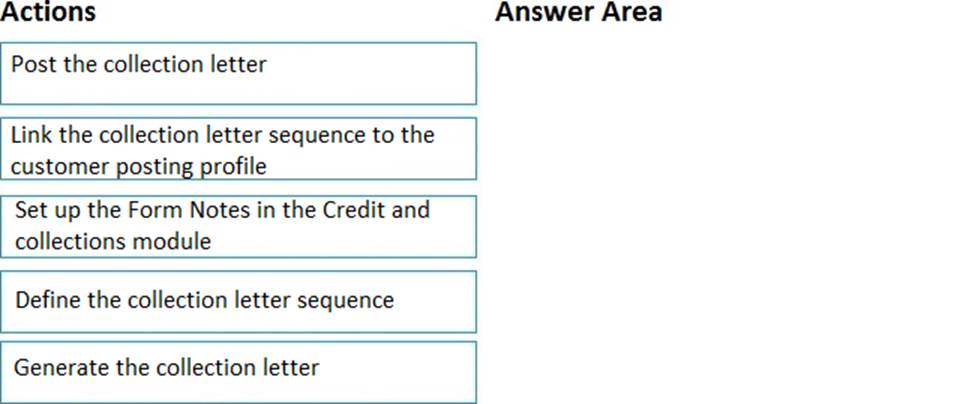

DRAG DROP

A client observes that some customers are late paying their invoices. The client wants to use the Credit and Collections functionality to send collection letters to customers.

need to configure the system to support collection letter functionality and processing.

In which order should you perform the actions? To answer, move all actions from the list of actions to the answer area and arrange them in the correct order.

Explanation:

Reference: http://d365tour.com/en/microsoft-dynamics-d365o/finance-d365fo-en/collection-letters/

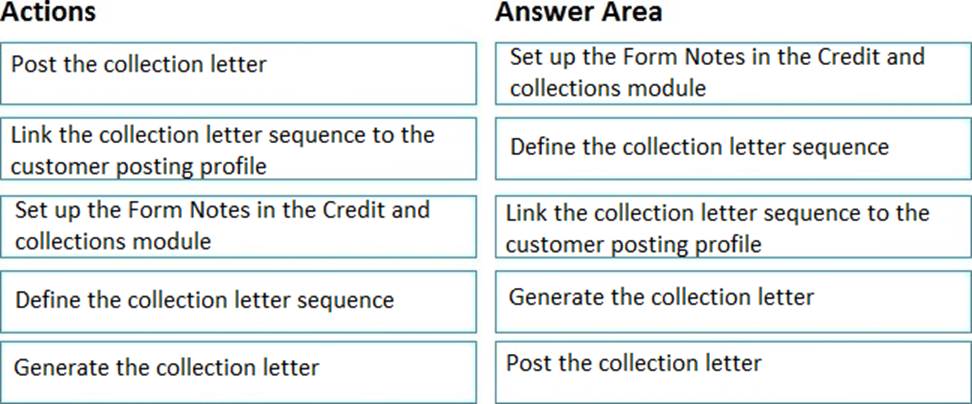

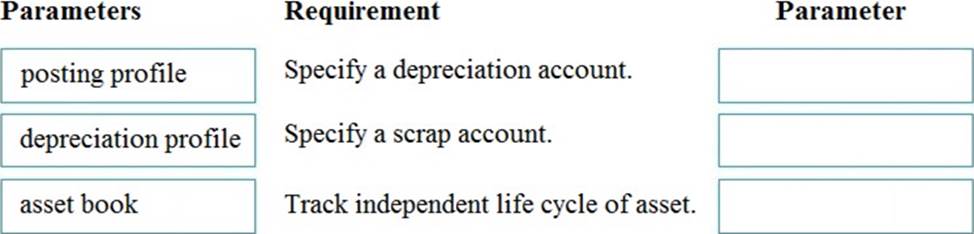

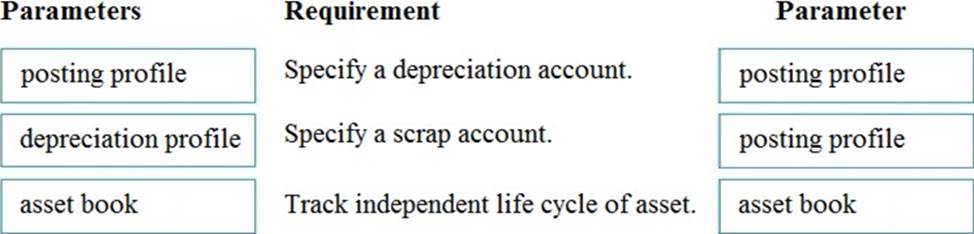

DRAG DROP

A client is implementing fixed assets in Dynamics 365 Finance.

You need to specify which parameters should be configured to meet the business requirements.

Which parameters meet the requirements? To answer, drag the appropriate parameters to the correct requirements. Each parameter may be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content. NOTE: Each correct selection is worth one point.

Explanation:

Reference:

https://docs.microsoft.com/en-us/dynamics365/finance/fixed-assets/tasks/set-up-fixed-asset-posting-profiles

https://docs.microsoft.com/en-us/dynamics365/finance/fixed-assets/set-up-fixed-assets

Which configuration makes it possible for User4 to make a purchase?

- A . Budget model configuration is configured to allow certain purchases to exceed budget.

- B . Budget is posted at the dimension level. Budget control is managed at main account level.

- C . Budget funds available are configured to allow dimension budget overrides.

- D . Budget is posted at the main account level. Budget control is managed at the department level.

You are implementing Dynamics 365 Finance.

You must configure a more accurate cash flow forecast related to sales tax. The sales tax calculation should be based on the expected transaction amounts and dates.

You need to configure the cash flow forecast.

Which setup should you use?

- A . Purchasing forecast defaults

- B . Bridging accounts

- C . Dependent accounts

- D . Sales forecast defaults

You are configuring the Fixed assets module for a Dynamics 365 Finance and Operations environment,

You need to set up the basic configuration to create a fixed asset Each correct answer presents part of the solution. NOTE: Each correct selection is worth one point.

- A . the number sequence

- B . the group

- C . the name

- D . the type

- E . the property type

ABC

Explanation:

Reference: https://docs.microsoft.com/en-us/dynamics365/unified-operations/financials/fixed-assets/tasks/create-fixed-asset

You need to prevent the issue from reoccurring for User5.

What should you do?

- A . Use the audit list search query type.

- B . Set up the aggregate query type for entertainment expenses.

- C . Set up the sampling query type for entertainment expenses.

- D . Add more keywords to the audit policy.

You need to prevent the issue from reoccurring for User5.

What should you do?

- A . Use the audit list search query type.

- B . Set up the aggregate query type for entertainment expenses.

- C . Set up the sampling query type for entertainment expenses.

- D . Add more keywords to the audit policy.

You need to resolve the issue that User4 reports.

What should you do?

- A . Change the status of the vendor collaboration request

- B . Create a vendor account with the systemexternaluser role and the vendor admin (external) role

- C . Remove the externalsystemuser role from the vendor

- D . Manually create the vendor account with the systemuser role

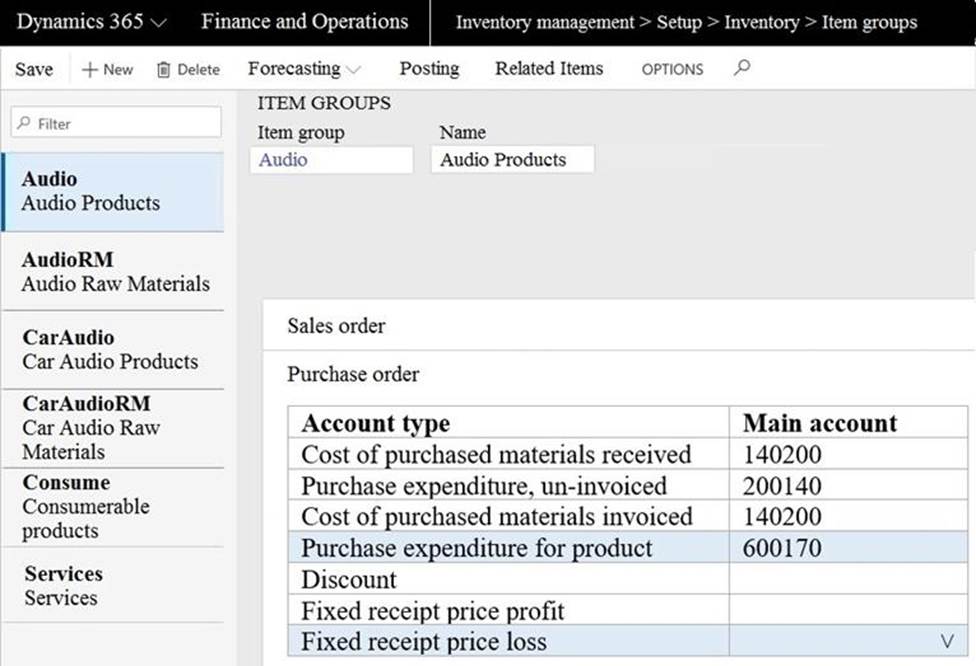

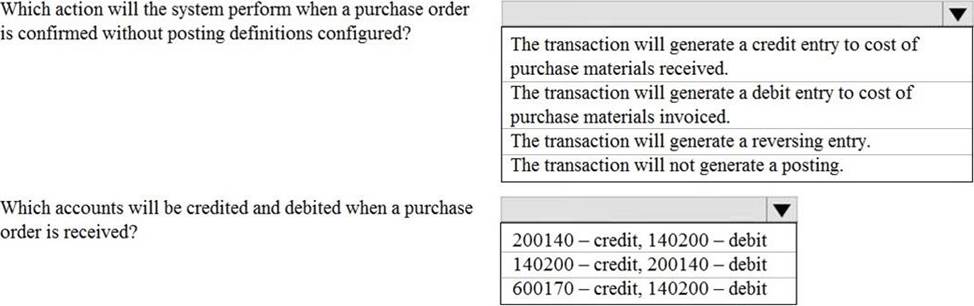

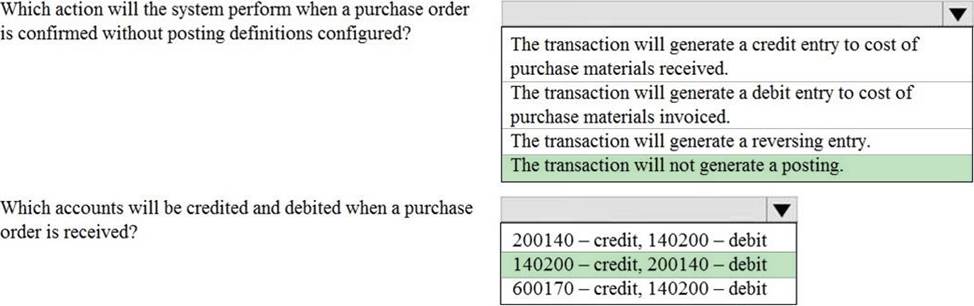

HOTSPOT

A private sector client needs item groups set up to support the procurement process.

The Audio Item group posting for a purchase order is configured as shown:

Use the drop-down menus to select the answer choice that answers each question based on the information presented in the graphic. NOTE: Each correct selection is worth one point.

Note: This question is part of a series of questions that present the same scenario. Each question in the series contains a unique solution that might meet the stated goals. Some question sets might have more than one correct solution, while others might not have a correct solution.

After you answer a question in this section, you will NOT be able to return to it. As a result, these questions will not appear in the review screen.

You are configuring the year-end setup in Dynamics 365 for Finance and Operations.

You need to configure the year-end setup to meet the following requirements:

– The accounting adjustments that are received in the first quarter must be able to be posted in to the previous year’s Period 13.

– The fiscal year closing can be run again, but only the most recent closing entry will remain in the transactions.

– All dimensions from profit and loss must carry over into the retained earnings.

– All future and previous periods must have an On Hold status.

Solution:

– Configure General ledger parameters.

– Set the Delete close of year transactions option to Yes.

– Set the Create closing transactions during transfer option to Yes.

– Set the Fiscal year status to permanently closed option to Yes.

– Define the Year-end close template.

– Designate a retained earnings main account for each legal entity.

– Set the Financial dimensions will be used on the Opening transactions option to Yes.

– Set the Transfer profit and loss dimensions’ option to Close All.

– Set future Ledger periods to a status of On Hold.

Does the solution meet the goal?

- A . Yes

- B . No

B

Explanation:

Reference: https://docs.microsoft.com/en-us/dynamics365/unified-operations/financials/general-ledger/year-end-close