Practice Free MB-310 Exam Online Questions

A client needs guidance on month-end closing procedures.

The client needs to be able to stop all teams except Accounts payable and General ledger from posting transactions for the month.

You need to configure Dynamics 365 Finance to allow only those two teams to transact during the period being closed.

Which three actions should you perform? Each correct answer presents part of the solution. NOTE: Each correct selection is worth one point.

- A . Create an access group called month end access for Accounts payable and General ledger team members.

- B . Set all modules to none to prevent any transactions from being posted.

- C . Configure the financial period close workspace tasks to the Accounts payable and General ledger teams only

- D . Move the period status to on hold for your client’s one legal entity.

- E . Assign the security group month end access on the ledger calendar form for the modules they need

access to.

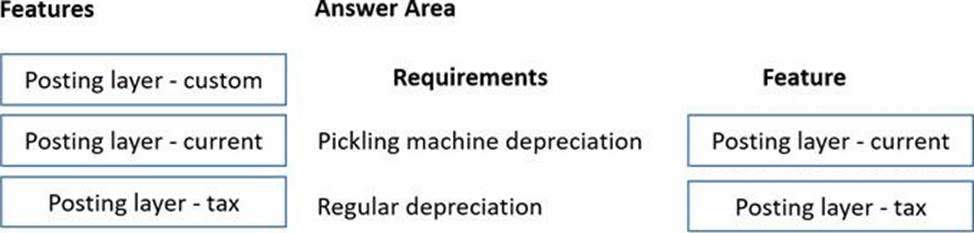

DRAG DROP

You need to select the functionality to meet the requirement.

Which features should you use? To answer, drag the appropriate features to the correct requirements. Each feature may be used once or not at all. You may need to drag the split bar between panes or scroll to view content. NOTE: Each correct selection is worth one point.

Explanation:

Reference: https://www.mscloudexperts.com/how-to-set-up-fixed-assets-to-register-transactions-in-posting-layers/

Your company uses Dynamics 365 Finance

All fixed assets are categorized by asset type. For example, office furniture is sequentially numbered.

Has the same service life, and uses the same depreciation deduction calculation.

You need to configure the system.

Which two parameters should you set up? Each correct answer presents part of the solution NOTL Each correct selection is worth one point.

- A . appreciation convention

- B . derived book

- C . deprecation profile

- D . fixed asset group

HOTSPOT

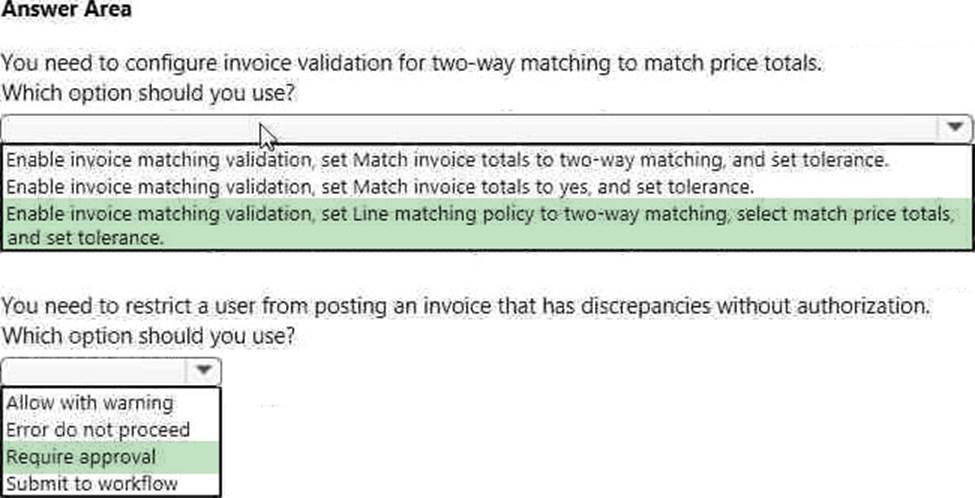

You need to configure invoice validation for vendors in Dynamics 365 for Finance and Operations. You are viewing the Accounts payable parameter for Invoice validation.

Use the drop-down menus to select the answer choice that answers each question based on the information presented in the graphic. NOTE: Each correct selection is worth one point.

Explanation:

Reference: https://docs.microsoft.com/en-us/dynamics365/finance/accounts-payable/tasks/set-up-accounts-payable-invoice-matching-validation

You are configuring the Fixed assets module for a Dynamics 365 Finance environment.

You need to create a fixed asset.

Which two settings are required? Each correct answer presents part of the solution. NOTE: Each correct selection is worth one point.

- A . the property type

- B . the group

- C . the number sequence

- D . the type

- E . the name

BE

Explanation:

The type and number sequence are configured in the group so you don’t need to enter those values.

Reference: https://ellipsesolutions.com/dynamics-365-finance-operations-fixed-asset-acquisition-options/

You are implementing Dynamics 365 Finance.

You commonly complete the sale of goods across international borders.

You need to configure the system.

What should you use?

- A . purchase agreement

- B . bank statements

- C . letters of credit

- D . promissory note

A company signs a four-year contract for an IT support project. The manager wants to know how the revenue amounts will be allocated across the four-year period. You need to implement a revenue schedule to determine the revenue amounts for each month.

Which setup should you use?

- A . 4 years

- B . 4 months

- C . 60 months

- D . 48 months

You are the controller for an organization. The company purchased six service trucks. You observe that your accountant set up Fixed assets – vehicles in the wrong fixed asset group.

You need to achieve the following;

• Change the fixed asset group so that the existing fixed asset transactions for the original fixed asset are canceled and regenerated for the new fixed asset.

• Ensure that all value models for the existing fixed asset are created for the new fixed asset Any information that was set up for the original fixed asset is copied to the new fixed asset.

• Close the old fixed asset number in the old fixed assets group and create a new fixed asset number in the new fixed assets group.

What should you do?

- A . Reclassify the fixed asset.

- B . Copy the fixed asset.

- C . Change the fixed asset group

- D . Transfer the fixed assets.

You are configuring account structures and advanced rules in Dynamics 365 Finance.

All balance sheet accounts require Business Unit and Department dimensions.

The Shareholder distribution account requires an additional dimension for Principal.

You need to set up the account structures.

What are two possible ways to achieve the goal? Each correct answer presents a complete solution. NOTE: Each correct selection is worth one point.

- A . Create a new main account for each of the company’s principals. Then, create an account structure for all balance sheet accounts that includes the required dimension.

- B . Create a new main account for Shareholder distribution. Add an advanced rule for the Principal dimension.

- C . Create an account structure for all the balance sheet accounts. Set up an advanced rule for the Shareholder distribution account for the Principal dimension.

- D . Create an account structure for balance sheet accounts without Shareholder distribution. Then, create a second account structure for Shareholder distribution that includes all required dimensions.

CD

Explanation:

Reference: https://docs.microsoft.com/en-us/dynamics365/finance/general-ledger/configure-account-structures

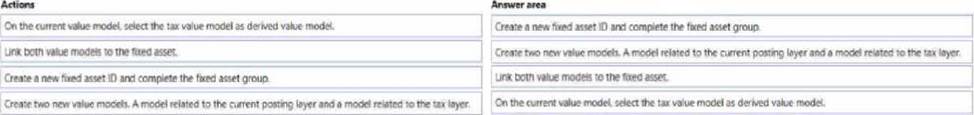

DRAG DROP

A company uses Microsoft Dynamics 365 Finance.

You receive a new purchase invoice. You must process the invoice as a fixed asset that complies with applicable tax regulations. Double entry is not permitted for asset acquisitions.

You need to configure the asset and books.

Which four actions should you recommend be performed in sequence? To answer move all actions from the list of actions to the answer area and arrange them m the correct order.